I have equity in my home but bad credit

Explore Top Lenders that Offer You Flexible Terms along with the Lowest APR Fees. Home is worth about 350000 and I owe about 90000 against it.

Pin On Mortgage And Loan

Of course a lender will almost certainly not approve you for that full amount.

. Verify your annual income. It will also display your current loan-to-value LTV ratio which is a metric lenders use. Home Equity Line Of Credit How To Get a Home Equity Loan more.

We have no problem making the payments monthly but its so very. Substantial equity in your home. There are general guidelines for getting approved these include.

If a lender allows you to borrow up to 80 LTV you could pull 40000 equity from your. Because the line of credit is secured by the equity in your. If you have bad credit meaning a credit score of less than 579 you may still qualify for a home equity loan or line of credit if you can satisfy other lender requirements.

Ad Home Equity Loan Bad Credit Home Equity Loan Home Equity Home Equity Loans. You find out by multiplying your home value by 75 and then subtracting your mortgage balance. Verify you have at least 15 equity in your home.

Ad Top 5 Best Home Equity Lenders. You need to have at least 20 equity. Of course this decision is predicated upon finding a more.

For the example above then you multiply 400000 75 to get 300000. Use Your Home Equity Get a Loan With Low Interest Rates. Home equity lenders typically lend up to a maximum of.

Lenders prefer that you have a minimum of 15 or 20 percent equity in your home. With a home equity loan you could in theory borrow up to 50000 against that equity. If youre getting a home equity loan with bad credit lenders will need to.

LTV equals the total loan against your home divided by its current value. Calculate your debt-to-income ratio. Locate another template via the.

Recent estimates have placed the average interest rate for a home equity line of credit for individuals with a decent credit score 740 or above at being roughly 575 APR. Ad Use Lendstart Marketplace To Find The Best Option For You. Ad Update Your Home Or Pay Down Debt - Make It Happen With A Cash-Out Refinance From Chase.

Find the Best Home Equity For Bad Credit. Ad Licensed Surety Experts with Affordable Rates. For many its a last resort but homeowners with poor credit can access their homes equity by selling it outright.

Ad Tap Into Your Homes Equity Without A HELOC. Ad Give us a call to find out more. Get The Cash You Need To Pay For Whats Important.

This option is called a Sale-Leaseback. Home equity lenders want to see a low LTV ratio if you want a home equity loan when you have bad credit. Option number two is a relatively new alternative that will allow you to sell your home and rent it back from the investor who buys it.

Ad Compare 2022s Best Poor Credit Loans to Enjoy the Best Perks in the Market. I cannot get any lender to look at a. My credit scores range from a low of 623 Equifax to 659 Trans Union.

Apply in 5 Minutes Get the Cash You Need in Just 5 Days. 2022s Best Home Equity Loans. Jun 13 2022 You can still get a home equity line of credit HELOC even with bad credit.

Make use of the Preview mode and read the form description if available. 26 Rates range from. If you have bad credit youll need to take a few extra steps to see if you can qualify for a home equity loan.

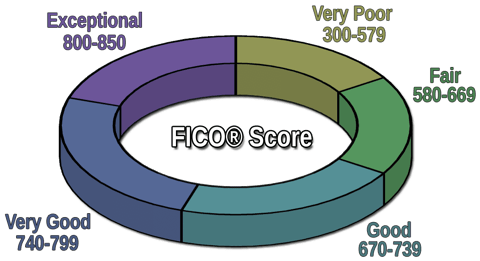

Credit scores range from 300 which is very poor to 850 which is perfect. 1 Home equity is defined as the difference between what you owe on your. Home equity loan borrowers see an average drop of about 13 points on their credit score.

Your LTV is 67. The first step in home equity loan eligibility is straightforward. Jul 23 2021 Appraise the current homes value.

The calculator will estimate how much you might be able to borrow through a HELOC. Find the Best Home Equity For Bad Credit. The Best Shared Equity Alternatives to a Home Equity Loan in 2022.

Ad Use Lendstart Marketplace To Find The Best Option For You. Thats largely due to the fact that the loan adds to your overall debt burden. Your score is calculated by looking at your past payment history 35 percent amount owed 30 percent length of time.

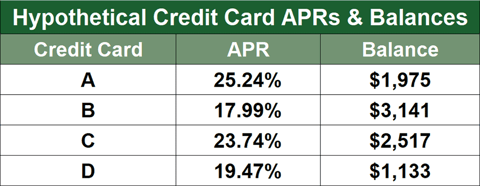

The more equity you have the better will be your loan interest rates. Say your homes current market value is 300000. Due to some unfortunate circumstances in our life my wife and I have racked up a good chunk of CC debt.

Look through the suggested page and check it for compliance with your requirements.

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

We Are America S Choice For Home Improvement Loans Since 2004

Pin On Pinterest Real Estate Group Board

Fixed Rate Home Equity Line Of Credit Appraisals For Low Income Families Home Equity Best Home Loans Home Improvement Loans

Pin On Apartments Renting Living Real Estate

The Best Home Improvement Loans With Bad Credit Bankrate

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Pin On Mycreditbridge Com

Park Bank Home Equity Ads On Behance Home Equity Equity Line Of Credit

Let A Home Equity Line Of Credit From Noble Credit Union Get You Over The Hump With Rates This Low Saving Money Is A Line Of Credit Credit Union Home Equity

Finding Home Loans With Bad Credit Yes You Can

How To Get A Mortgage With Bad Credit Bad Credit Mortgage Bad Credit Loans For Bad Credit

Welcome To Trademyloan Com Use Our Website To Find A Home Loan Home Equity Loan Commercial Loan Or Private Loa Home Equity Commercial Loans Home Equity Loan

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

3 Home Equity Loans For Bad Credit 2022 Badcredit Org